Fintech is no longer the same with the efficiency borne by RPA. In 2022, it is set to add more benefits to specific tasks. Many leaders in the industry feel that implementing new technologies is the way to go. It is not only the cost-savings that the institutions will benefit from in 2022. With the integration of AI and ML, the lessons will also include raising security levels to review fraudulent cases and monitor red flag moments.

Other industries are also experimenting with the help of software robotics for a better employee and customer experience. But can this be the only answer to accelerate the business processes internally and in the marketplace?

Robotic process automation will soon race past cloud computing and it has a significant role play in the near future. The earlier industry leaders comprehend its significance, the better will be the digital transformation and operational efficiency in the organization. And it is very significant for the financial sector which needs security at every stage for its never ending business processes. Bots are now integral to tis sector. They can handle repetitive tasks better and are a part of hyperautomation. As humans do not interfere there are less chances of errors.

Software bots have increased pro-active engagement significantly. Organizations which use them have positive results of auto extraction capabilities. The next surge now lies with robotic process automation. The technology is now maturing, and leaders need to understand this new surge in its evolvement. It is reshaping business process management in the following 3 ways.

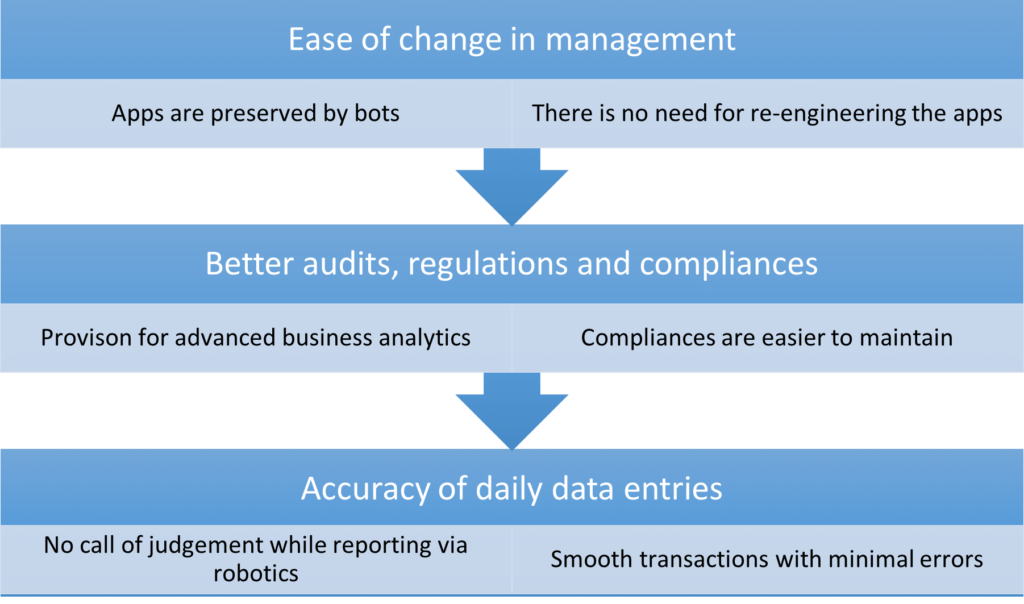

The following diagram offers the best case scenario for the financial sector in 2022 to improve business.

When software bots are used there is immense cost reduction and increase in efficiencies. Even top organizations need to keep tight budgets and this seems to be the best method to do so. It is so easy to implement that it works well with other cognitive technologies. Any organization that has a well developed IT department can get the systems configured in less time and connect to back office.

RPA in this sector can be improved by:

Driving growth and sustaining it due to stiff competition. Low interests and high cost of digital transformations is killing the budgets. But upgrading is important to mitigate risks. RPA allows bankers to detect cross-selling opportunities and convert them at the earliest to make a better financial product portfolio. With the consumer behaviour data, recommendations can be made to them.

There is no better way to improve operational efficiency: RPA is the best bet.

If you are thinking of adding RPA in your enterprise, it is not the only game changer that will make the difference. There are challenges ahead of many smart tools users that will have to be accepted. No matter which organization is deploying it, to succeed it will require well-defined goals and intents for better responses. For anyone working within an organization, it is important to get any piece of information and also check on the status of the task being assigned with it.

As the number of machines and devices have increased, many people deal with them with limited knowledge. Machines and devices have been dumb in the past (i.e., reactive), but now they can ‘speak up’, ‘answer queries’ or even ‘hold conversations’ and perform tasks that humans assign them. They have become proactive in nature and prompt answers for the users. It is a great step forward, and now the focus is on enhancing the user experience.

Is your bank not getting any response form customers? This is a clear indication that you need RPA to accelerate their engagement. Consumers have several options and it is essential to keep the flock together. They want personalized services and have high expectations from the banks. RPA tools can be useful to please them and also update KYC documents simultaneously. Customer complaints, mobile features and direct contact can be established.

Combating financial crimes

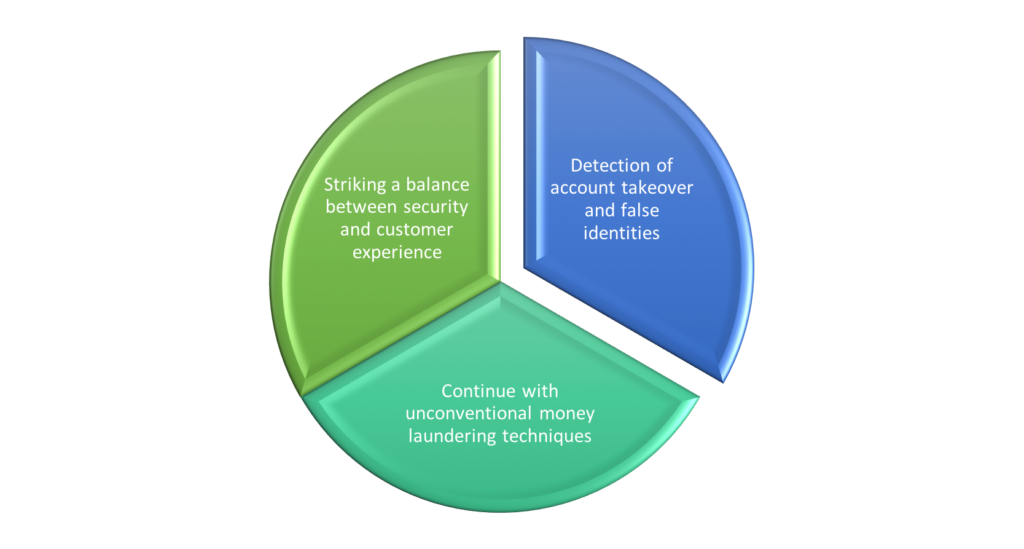

Pushing various capabilities of artificial intelligence in financial crimes, fraud and risk management continues to bring on the table critical issues to tackle with agility. While no one denies that this technology has the potential to crack the most hardened fin-criminal, several ethical concerns remain a strong point in its implementation. Financial institutions cannot continue to play the ‘cat & mouse’ game with fraudsters and risk losing assets in the bargain.

Risks being carried forward in 2022

Security measures will continue to see testing times with vulnerabilities and exposure to bugs. Possibilities of vector attacks will remain high. The only way is to uncover the fraud ‘as it happens’ with technology investments.

Due to continuous digital transformation and virtual payments, trends in fraudulent deals will put spotlight on 3 aspects:

Banking on AI for Financial Crime Compliances

There is a saying about a ‘stitch in time’ we need to modify it with ‘Usage of AI technology in time saves dimes.’ The nature of crime will continuously change and the regulatory framework will need to keep pace. With data integrity, banks can fight criminal activity effectively and manage regulatory compliance globally while doing daily business. Loss of revenue is primarily because of criminal acts related to:

- Tax evasion

- Money Laundering

- Corruption

- Instability of organizations to keep up with technology to stave off criminals

- Lagging behind in regulatory compliances

Is there any excuse now for not adopting RPA processes for your bank’s needs?